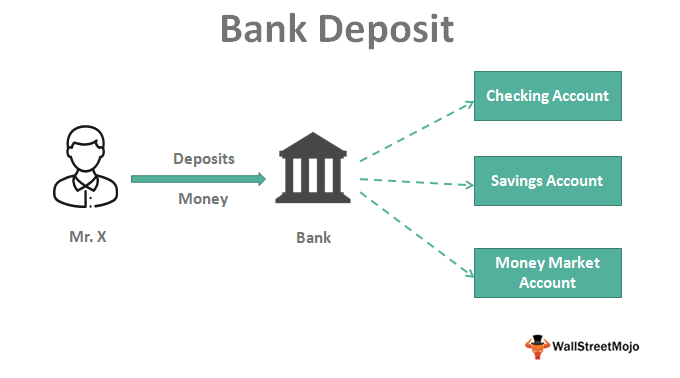

Deposit accounts are fundamental financial tools that facilitate the management of your money. They enable you to deposit, withdraw, and often grow your funds, providing a range of options to suit different financial needs and goals. Understanding the various types of deposit accounts and their specific features can help you make informed decisions about where to keep your money. This guide delves into the main types of deposit accounts, their functionalities, and key considerations to help you choose the best account for your situation.

Types of Deposit Accounts

1. Checking Accounts

Checking accounts are designed for everyday financial transactions. They are ideal for managing day-to-day expenses, paying bills, and handling frequent deposits and withdrawals. Key features include:

- Frequent Transactions: Checking accounts support unlimited transactions, allowing you to deposit and withdraw money as needed.

- Access Tools: They come with debit cards and checkbooks, making it convenient to access funds and make payments.

- Overdraft Protection: Many checking accounts offer overdraft protection, which allows transactions to be authorized even if your balance is insufficient, though this may come with associated fees.

Checking accounts generally do not earn interest, but their flexibility and ease of access make them essential for routine financial management.

2. Savings Accounts

Savings accounts are designed to encourage saving by offering interest on your balance. They are a good option for setting aside money for future goals or creating an emergency fund. Key characteristics include:

- Interest Earnings: Savings accounts typically offer interest, although rates can vary. As of now, traditional savings accounts have average annual percentage yields (APYs) around 0.42%, while high-yield savings accounts, often provided by online banks, may offer APYs exceeding 5%.

- Limited Transactions: There may be restrictions on the number of free electronic transfers and withdrawals per month—often six. This encourages saving while still providing access to your funds when needed.

- No Debit Card: Unlike checking accounts, savings accounts usually do not come with a debit card or checkbook.

Savings accounts are suitable for short-term savings and emergency funds, offering a safe place to grow your money with minimal risk.

3. Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are fixed-term deposits that offer higher interest rates compared to regular savings accounts. They are ideal for funds you do not need immediate access to. Key features include:

- Fixed Term: CDs have a fixed term ranging from one month to five years. The longer the term, the higher the interest rate typically offered.

- Early Withdrawal Penalties: Withdrawing funds before the end of the term usually incurs a penalty, making CDs less flexible but more secure for those who can commit their money for a specified period.

- Higher Interest Rates: CDs often provide higher APYs, sometimes up to 5.5%, depending on the term and financial institution.

CDs are well-suited for medium- to long-term savings goals, providing a low-risk way to earn interest.

4. Money Market Accounts

Money market accounts (MMAs) blend features of checking and savings accounts, offering both interest earnings and access tools. Key aspects include:

- Interest Earnings: MMAs offer competitive APYs, with some accounts yielding rates in the top 5%.

- Access Tools: They often come with debit cards or checkbooks, allowing for easy access to funds.

- Transaction Limits: Similar to savings accounts, MMAs may limit the number of free transactions or electronic transfers per month. They may also have minimum balance requirements and management fees.

MMAs are ideal for those who want to earn interest while maintaining relatively easy access to their funds.

Deposit Accounts vs. Checking Accounts vs. Savings Accounts

“Deposit account” is a broad term encompassing various types of bank accounts, including checking and savings accounts. Each type serves different purposes:

- Checking Accounts: Best for frequent transactions and daily financial management. They generally do not earn interest.

- Savings Accounts: Designed for saving money with the benefit of earning interest. Transactions are limited, encouraging savings.

- CDs: Offer higher interest rates for funds locked in for a fixed term. Suitable for medium- to long-term savings with early withdrawal penalties.

- Money Market Accounts: Combine features of checking and savings accounts with competitive interest rates. They may come with higher balance requirements and transaction limits.

Understanding these distinctions helps in choosing the most appropriate account for your needs, whether it’s for everyday transactions, saving for future goals, or earning higher interest on longer-term deposits.

Conclusion

Deposit accounts are essential financial tools that cater to a range of needs and financial goals. From the daily utility of checking accounts to the interest-bearing benefits of savings accounts, CDs, and money market accounts, each type of deposit account serves a specific purpose in managing and growing your money.

Checking accounts provide the flexibility needed for everyday transactions and bill payments, offering convenience through debit cards and checkbooks. Savings accounts, on the other hand, encourage saving by offering interest on deposited funds, making them ideal for emergency funds or short-term savings goals. Certificates of Deposit (CDs) offer higher interest rates for funds committed for a fixed term, providing a secure way to grow your money over time. Money Market Accounts (MMAs) blend features of both checking and savings accounts, offering competitive interest rates and easy access to funds, albeit with potential minimum balance requirements and transaction limits.

When choosing a deposit account, consider your financial goals, transaction needs, and how much access you require. Each account type has its advantages, and understanding these can help you optimize your financial management. For instance, if your priority is frequent access to funds without earning interest, a checking account might be your best bet. If you are looking to grow your savings with minimal risk, a savings account or CD could be more appropriate. Meanwhile, a money market account offers a balance between earning interest and maintaining accessibility.

It’s also important to note that deposit accounts are insured by the Federal Deposit Insurance Corp. (FDIC) or the National Credit Union Administration (NCUA), providing protection up to $250,000 per depositor per insured bank or credit union. This insurance adds a layer of security, ensuring that your funds are safe even if the financial institution faces challenges.

As you evaluate different deposit accounts, take the time to compare interest rates, fees, and terms across various financial institutions. This will enable you to select the account that aligns with your financial needs and goals. Additionally, consider any special features or benefits that may be offered by different banks or credit unions, such as fee-free ATMs, early paycheck deposits, or tools to help manage your finances.

In summary, deposit accounts are vital tools for managing your money, offering various options to suit different financial situations. By understanding the features and benefits of each type of deposit account, you can make informed decisions that help you achieve your financial objectives while ensuring your funds are secure and accessible.