Cash flow forecasting is the process of estimating the flow of cash into and out of a business over a period of time. Accurate cash flow forecasting helps companies anticipate future cash positions, avoid crippling cash shortages, and generate revenue from any cash surpluses they may have in the most efficient way possible. Cash flow […]

Effective Cash Flow Analysis: Tools and Tips for Maintaining Financial Stability and Growth

Performing a cash flow analysis allows you to view your cash flow statement under a microscope to see the movement of money into and out of your business. A cash flow analysis shows whether your business is earning enough income to cover financial obligations and whether you have money left over after paying your bills. […]

“Unlocking the Secrets of Liquidity Management: Essential Techniques for Business Success”

Liquidity management has become a fundamental aspect of cash flow management as businesses increasingly seek to optimize their working capital. As more and more companies operate on tight margins, it is important to understand what liquidity is and how it can be effectively managed. But what exactly is liquidity? Liquidity refers to a company’s ability […]

Top Loan Products Explained: From Personal Loans to Commercial Financing

In the world of business, the adage “you have to spend money to make money” often rings true. However, many entrepreneurs face challenges when trying to secure the necessary funds to advance their businesses. Fortunately, there are various commercial loan products designed to meet diverse financial needs, whether you’re looking to acquire real estate, purchase […]

Corporate Banking Solutions in Commercial Banks: A Comprehensive Overview

Corporate banking is a crucial segment of the banking industry, providing specialized financial services tailored to the needs of businesses, from small enterprises to large corporations. Unlike retail banking, which focuses on individual consumers, corporate banking solutions cater specifically to the unique financial requirements of businesses. This essay explores the various aspects of corporate banking […]

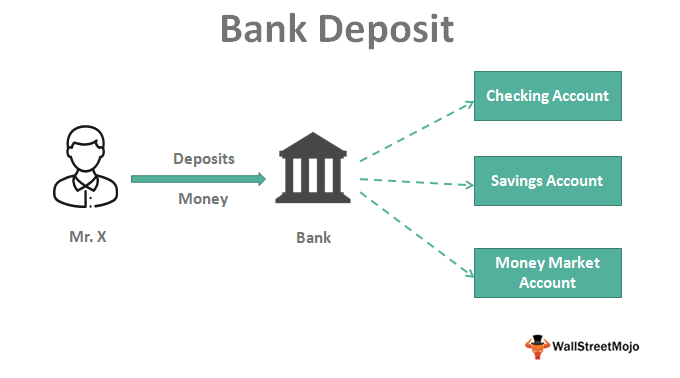

How Deposit Accounts Work: A Comprehensive Overview of Banking Options

Deposit accounts are fundamental financial tools that facilitate the management of your money. They enable you to deposit, withdraw, and often grow your funds, providing a range of options to suit different financial needs and goals. Understanding the various types of deposit accounts and their specific features can help you make informed decisions about where […]

Navigating Mortgage Loans: Essential Tips for First-Time Homebuyers and Refinancers

Mortgage loans are essential financial instruments that enable individuals and businesses to purchase real estate by borrowing funds from a lender. They are secured by the property itself, meaning that if the borrower fails to repay, the lender can claim ownership of the property through foreclosure. Understanding how mortgage loans work, the different types available, […]

Navigating Banking Regulations: Essential Compliance Tips for Financial Institutions

Banking regulations are essential frameworks that govern the operations, practices, and policies of financial institutions. These regulations are designed to ensure the stability, integrity, and efficiency of the banking system, protect consumers, and promote public confidence. This guide explores how banking regulations work, the different types, their importance, potential disadvantages, and concludes with insights on […]

Understanding Bank Risk Management: A Comprehensive Approach to Mitigating Financial Risks

Financial risk management is a crucial discipline in the world of finance, aiming to identify, assess, and mitigate risks that can impact the financial health of an organization. With the dynamic nature of financial markets and the increasing complexity of financial instruments, effective risk management has become more vital than ever. This article delves into […]

Effective Corporate Valuation: Tools and Insights for Strategic Business Decisions

Corporate Valuation in Finance: A Comprehensive Guide Corporate valuation is an essential process in finance that determines the worth of a company. This assessment is crucial for a variety of financial activities including mergers and acquisitions, investment analysis, financial reporting, and strategic decision-making. Understanding the principles, methodologies, and factors involved in corporate valuation is vital […]